12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

- December 09, 2023

- 2 minutes

In the fast-paced and dynamic world of mortgage lending, utilising mortgage loan origination software (LOS) is no longer an option, but a necessity. Despite its ubiquity, the complexities and nuances of LOS can often leave even the most adept professionals in a quandary. Reflecting on my journey, there are twelve key aspects related to LOS I wish I'd understood better before embarking on its implementation.

- The Cruciality of Customization: Mortgage loan origination software is not a one-size-fits-all solution. Each organization has unique requirements, regulatory obligations, and workflow preferences, therefore, a tailored LOS is often the need of the hour. This signifies the importance of customization – a critical feature that allows you to adapt the LOS according to your specific operational needs.

- Integration Capabilities: LOS does not stand alone. It must interact fluidly with other software systems such as customer relationship management (CRM) tools, document management systems, and underwriting software. Thus, ensuring the LOS chosen is capable of seamless integration is paramount to avoid potential bottlenecks and inefficiencies.

- The Power of Automation: Amid the complexities of mortgage lending, LOS capabilities extend beyond simple information management. Automating routine tasks such as data entry, compliance checks, and document generation can significantly improve efficiency, reduce human error, and expedite loan approval processes.

- Training Time: Implementing a new LOS is not an overnight process. It necessitates rigorous training for staff to navigate and optimize its functionalities. Overlooking this aspect can lead to suboptimal use or even detrimental errors.

- Cost vs. Benefit: While considering the cost of LOS, one must take into account not just the upfront cost but also the ongoing maintenance and upgrade costs. Measuring these against the potential benefits in terms of enhanced efficiency, reduced error, and improved compliance can provide a more holistic perspective on the return on investment.

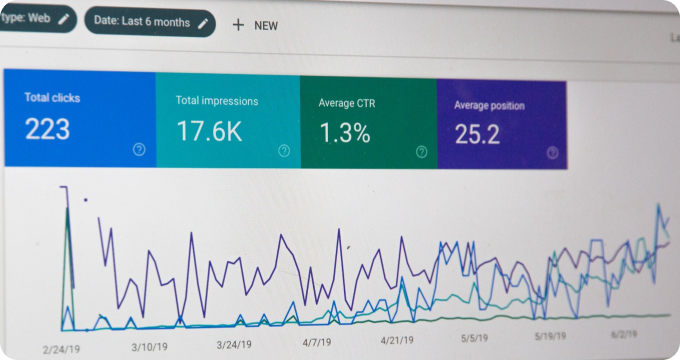

- The Role of Analytics: In this age of data-driven decision-making, the ability of LOS to generate insightful analytics is a boon. From tracking loan performance to identifying trends, LOS analytics can empower strategic decisions and optimize lending operations.

- Scalability: As your business grows, your LOS should be capable of growing with it. Scalability is therefore, a crucial factor to consider. The LOS chosen should be capable of handling an increased volume of loans and adapting to expanded operations.

- Security Measures: Given the sensitive nature of data involved in mortgage lending, robust security features are a necessity in your LOS. Look for software that provides strong data encryption, user authentication, and regular security updates to protect against potential threats.

- Compliance Management: Navigating the labyrinthine world of regulatory compliance is a major challenge in mortgage lending. A good LOS should have inherent compliance checks and alerts to ensure conformity with regulations.

- Vendor Reputation and Support: The reputation of the LOS vendor in the market is a significant consideration. Vendor credibility, their track record in terms of updates and bug fixes, and the quality of their customer support can significantly impact your LOS experience.

- Cloud-based vs. On-premise: While on-premise LOS gives you more control, a cloud-based solution offers flexibility, scalability and reduced IT overheads. Weighing the pros and cons of each based on your specific needs can help in making an informed choice.

- The Impact on Borrower Experience: Finally yet importantly, the impact of LOS on the end-user - the borrower, is often overlooked. The software should simplify the loan application and approval process, ensuring a smooth and pleasant experience for the borrower.

In conclusion, while the implementation of mortgage loan origination software may seem daunting, understanding these facets can provide valuable insights and lead to a more informed, strategic decision. Remember, the ultimate goal of implementing LOS is to streamline operations, enhance efficiency, and ultimately, better serve your clients. Therefore, a careful, considered approach towards understanding and implementing LOS can go a long way in achieving these objectives.

Learn More

Unleash the power of financial technology and elevate your lending game by diving deeper into our enlightening blog posts about mortgage loan origination software. For an unbiased, comprehensive view, the reader is urged to explore our meticulously curated rankings of the Best Mortgage Loan Origination Software.

Popular Posts

-

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

-

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

-

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

-

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

-

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You