10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

- November 04, 2023

- 3 minutes

Mortgage Loan Origination Software (MLOS) is a tool that has revolutionized the financial world, transforming the labyrinthine process of mortgage origination into a streamlined, efficient procedure. However, the vast array of options available can make the selection of an appropriate MLOS a daunting task. In this post, we will dissect the intricate considerations that must be addressed when selecting an MLOS, and we’ll provide ten essential questions that will help guide your decision-making process.

-

What is the software’s ease of use?

A fundamental principle of human-computer interaction, postulated by the renowned Jakob Nielsen, states that a user-friendly system minimizes the users' effort to learn and use it. See if the MLOS you're considering adheres to this principle. Can it be used without extensive training? Is the user interface intuitive? More user-friendly systems can reduce training costs and increase efficiency.

-

What integrations does the software offer?

Your MLOS should ideally be an all-encompassing solution. Still, it's a fact that some processes might be handled better by other specialized software. That's where integration capabilities come into play. Can the MLOS connect with your CRM system, for instance? If so, it will significantly enhance collaboration and information flow within your organization.

-

What kind of customization options does the software offer?

While standardization is necessary, it shouldn't be so stringent as to stifle operational flexibility. Ask yourself, does the MLOS allow for customization to suit your specific needs? The ability to modify forms, rules, and workflows can lead to increased efficiency and better customer service.

-

What is the software's scalability?

Will the MLOS be able to accommodate your business’s growth? Scalability is a key aspect to consider. Einstein's theory of relativity doesn't just apply to the cosmos, but it's also applicable here. As your mortgage business expands (in time and space), your MLOS should be capable of handling the increased workload.

-

How secure is the software?

As per Parkinson's law of trifles, even seemingly insignificant details can have immense consequences. In an era marred by data breaches and cyber-attacks, the security of an MLOS is one such 'trifle'. Enquire about the software's security features. Does it comply with industry standards like ISO 27001 or SOC 2? A secure system can prevent potential financial and reputational losses.

-

What kind of support services does the vendor provide?

Support services are crucial for troubleshooting and ensuring smooth operations. Does the vendor offer extensive support services, 24/7, or during business hours? Also, consider the type of support they offer – is it only via email, or can you reach them through phone or live chat as well?

-

How compliant is the software with industry regulations?

Mortgage origination is a heavily regulated industry. Non-compliance can lead to hefty fines and legal problems. Hence, your MLOS should keep abreast with the changing regulatory landscape. Check if the software is updated regularly to reflect changes in industry regulations.

-

What is the cost of the software?

The Pareto principle, or the 80/20 rule, states that for many events, roughly 80% of the effects come from 20% of the causes. When budgeting for an MLOS, remember that the total cost of ownership usually goes beyond the initial purchase price. It may include costs for training, maintenance, upgrades, and potentially, penalties for early contract termination.

-

Can the software handle multi-channel origination?

In the era of digitalization, customers may approach you through multiple channels – online, offline, or mobile. The ability of an MLOS to handle multi-channel origination can enhance customer experience and streamline your operations.

-

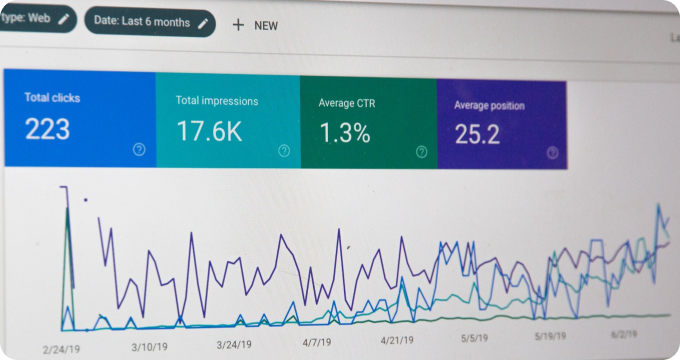

What are the software’s reporting and analytics capabilities?

In the words of renowned mathematician Clive Humby, "Data is the new oil." The ability of an MLOS to provide insightful reports and analytics can help you make informed business decisions.

In conclusion, selecting an MLOS is not a decision to be taken lightly. It requires a deep understanding of your business needs, a keen eye for detail, and a rigorous comparison of your available options. By asking these ten questions, you can ensure that the MLOS you choose is not only an effective tool for mortgage origination but also a valuable asset to your business.

Learn More

Unleash the power of financial technology and transform your mortgage business by diving deeper into our insightful blog posts about mortgage loan origination software. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best Mortgage Loan Origination Software.

Popular Posts

-

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

-

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

-

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

-

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

-

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You