12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

- December 23, 2023

- 3 minutes

In a world that is constantly evolving, powered by relentless technological progress and digital integration, businesses are seeking efficient and effective ways to streamline their operations. The mortgage industry is no different. Central to this change is the introduction and application of Mortgage Loan Origination Software (LOS), a powerful tool that can transform the way firms manage their mortgage businesses.

Loan Origination Software, in its simplest terms, is a platform that allows lenders to automate the lending process, from application to disbursement and even beyond. With an increasingly competitive mortgage market, LOS solutions are becoming an indispensable part of the mortgage business, a sort of technological imperative, if you will.

Here, we delve into twelve compelling reasons which argue for the necessity of LOS in any mortgage business striving for success and growth in the 21st century and beyond.

-

Efficiency: An LOS system can significantly reduce the time taken to process a loan - a reduction directly proportional to the increase in productivity. It achieves this by automating numerous tasks that would have traditionally required manual labor, such as data entry and document management.

-

Accuracy: Human error is essentially an inevitability in manual processes. However, with an LOS, the possibility of mistakes is dramatically reduced, leading to more accurate loan processing and underwriting.

-

Compliance: Regulatory compliance is a critical aspect of the mortgage industry. An LOS keeps track of regulatory changes and ensures that all loan processes are in compliance with current laws and regulations, thereby reducing the risk of non-compliance penalties.

-

Customer Service: With an LOS, institutions can offer superior customer service, facilitating quick responses to inquiries and providing customers with real-time updates on their loan status.

-

Competitive Advantage: With speed, accuracy, and improved customer service, mortgage businesses can gain a competitive advantage in the market, leading to increased market share and profitability.

-

Risk Assessment: LOS systems can integrate sophisticated algorithms and predictive models to aid in the assessment of risk, providing a more accurate representation of a borrower's creditworthiness.

-

Cost-Effective: By streamlining and automating numerous processes, an LOS can reduce overhead costs associated with manual labor and document storage.

-

Paperless Process: With everything digital, businesses can significantly reduce their dependence on paper, contributing to environmental conservation efforts while also enhancing security and accessibility of documents.

-

Seamless Integration: LOS can seamlessly integrate with other software systems, such as Customer Relationship Management (CRM) and financial software, creating a fluid, interconnected system that enhances business operations.

-

Scalability: As your business grows, so too can your LOS. Its ability to efficiently process high volumes of loans makes it a scalable solution suited to both small and large businesses.

-

Customization: Different mortgage businesses have different needs. LOS systems offer customization options that allow businesses to tailor the software to their specific requirements and processes.

-

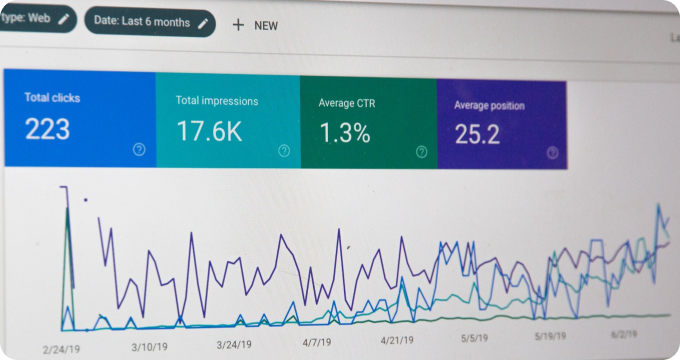

Data Analysis: LOS systems can generate insightful analytics and reports based on the collected data, aiding in strategic decision-making processes.

It's evident from the myriad benefits outlined above that an LOS can revolutionize the way a mortgage business operates, enhancing efficiency, accuracy, compliance, customer service, amongst others. It's an investment that can offer significant returns in both the short and long term.

However, it's critical to note that not all LOS solutions are created equal. Various platforms may excel in different areas, offering unique functionalities and benefits. It's therefore essential that businesses carefully evaluate different LOS solutions, considering aspects such as features, integration capabilities, customization options, and scalability, to choose one that aligns with their unique needs and objectives.

Though the initial investment may seem substantial, the potential returns—in terms of cost savings, improved efficiency, and enhanced customer service—could significantly outweigh the costs. In the grand scheme of things, an investment in an LOS solution is, in reality, an investment in the future of a business. With the rapidly changing technological landscape, it's not just an option; it's a necessity.

Learn More

Unleash the power of financial technology and elevate your lending game by diving deeper into our insightful blog posts about mortgage loan origination software. For an unbiased, comprehensive view, the reader is encouraged to explore our meticulously curated rankings of the Best Mortgage Loan Origination Software.

Popular Posts

-

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

12 Compelling Reasons Why Your Mortgage Business Needs Loan Origination Software

-

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

Debunking 10 Myths About Mortgage Loan Origination Software: A Comprehensive Guide

-

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

12 Things I Wish I'd Known About Mortgage Loan Origination Software Before Implementing One

-

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

10 Essential Questions to Ask Before Choosing a Mortgage Loan Origination Software

-

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You

Ask These Questions to a Mortgage Loan Origination Software Provider to Choose the Right One for You